For years, the multitrillion-dollar sustainability market segment has been navigating a critical blind spot- the unregulated and mostly opaque realm of ESG ratings. ESG ratings are scores assigned to companies based on performance against specific environmental, social, and governance criteria. Powerful drivers of capital allocation and corporate reputation, these ratings have generated widespread confusion, skepticism, and complaints of “greenwashing.”

This ambiguity is now coming to an end in the United Kingdom. In a landmark move, the government has introduced legislation to bring ESG ratings providers under the formal supervision of the Financial Conduct Authority (FCA). It is not just a regulatory update but a game-changer that would significantly alter how companies are evaluated and investors deploy capital, setting a new global benchmark for market integrity.

Why Regulate ESG Ratings? Understanding the “Wild West”

To understand why this regulation is a game-changer, we must first answer a fundamental question: what are ESG ratings?

Think of them as a credit rating for ESG. Providers analyze a company’s data on everything from carbon emissions and water usage to labor practices and board diversity, distilling it into a single, comparable score or grade. These ESG ratings are used by investors to identify risks and opportunities, by companies to benchmark their performance, and by lenders to assess long-term viability.

However, the market has been characterized by a lack of uniformity. Different providers use vastly different ESG ratings methodologies, leading to startling discrepancies. A company could receive a top score from one agency and a mediocre one from another, creating confusion and undermining trust.

The core issues the UK seeks to address are:

- Methodological Opacity: Lack of clarity on how scores are calculated.

- Conflicts of Interest: Providers often offer consulting services to the same companies they rate.

- Data Gaps: Inconsistent or poor-quality underlying data, particularly on complex areas like Scope 3 emissions management.

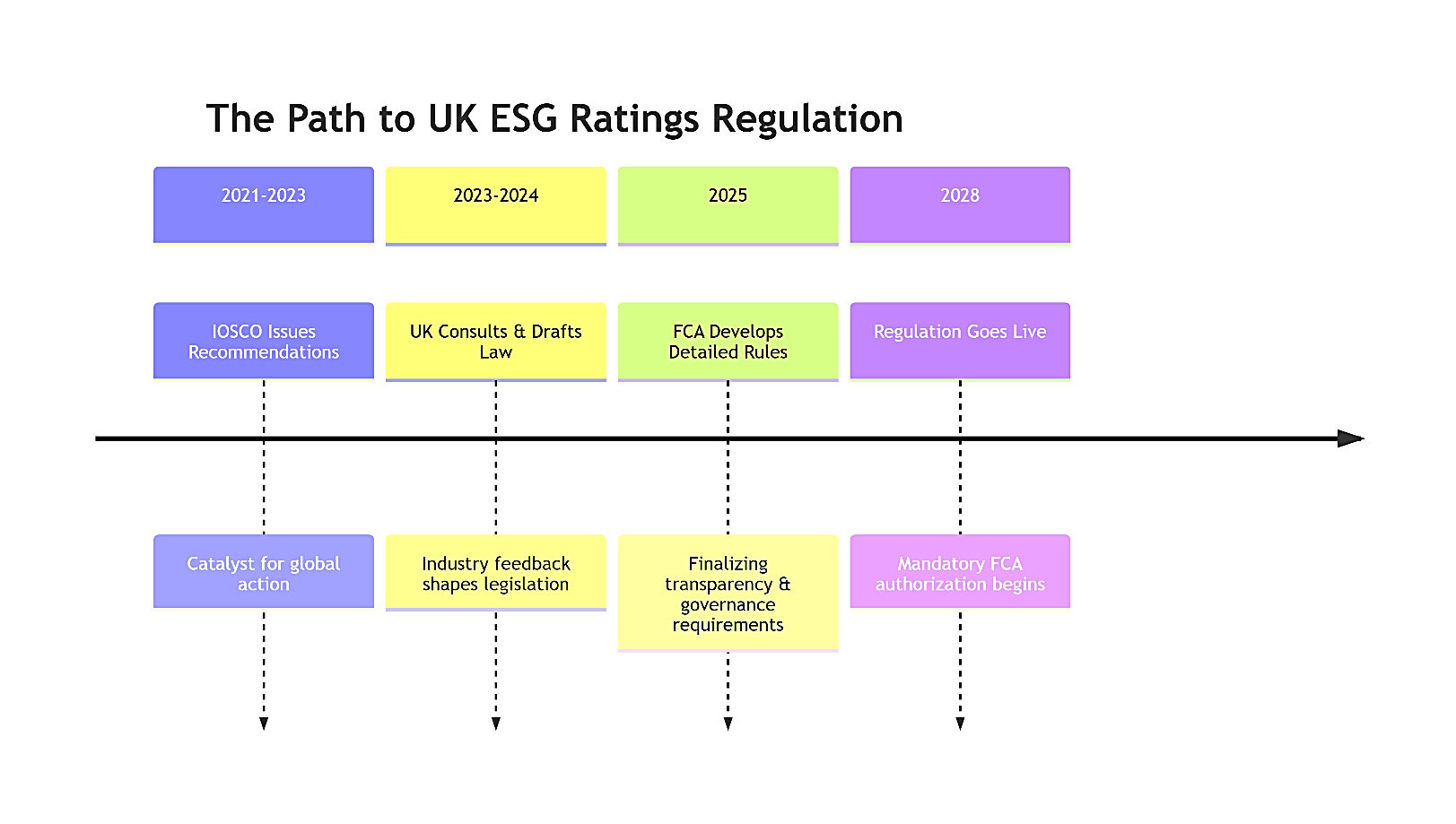

As the International Organization of Securities Commissions (IOSCO) highlighted in its 2021 recommendations, which catalyzed this global regulatory trend, these weaknesses pose a significant risk to market confidence.

UK ESG Regulation: A Deep Dive

This new regulation is anticipated to come into force in June 2028 and sets out an all-encompassing framework for the regulation of ESG ratings in the UK. The following are further details:

- The Mandatory authorization includes that any ESG ratings provider operating in the UK, whether domestic or foreign, is authorised by the FCA.

- The “Four Pillars” of FCA Oversight: The regulator has announced it will base its rulebook on key IOSCO ESG recommendations, focusing on:

- Transparency: making available methodologies, data sources, and assumptions underpinning those.

- Governance: Creating strong internal systems and accountability.

- Systems and Controls: Implement processes to ensure quality.

- Management of Conflicts of Interest: Observing and mitigating potential biases.

The Ripple Effect: What This Means for Businesses & Investors

For Companies

Demand for audit-ready ESG data will intensify. Due to UK-regulated ratings, the corporate disclosures will be under the spotlight. Fragmented and unclear reporting on key issues, such as carbon emissions or social metrics, will directly translate into lower ESG ratings. The focus shifts to the integrity of the underlying data.

For Investors

Asset managers and institutional investors can feel a new level of confidence. FCA ESG ratings will supply a more sound basis for informed investment decisions and discharging their own fiduciary and regulatory obligations, such as those under SFDR. This helps combat “greenwashing” and ensures capital flows to genuinely sustainable enterprises.

The Global Stage

The UK is not acting in a vacuum. The EU has its own ESGR regulation in the works, while Singapore’s MAS has already published a code of conduct. The action from the UK gives significant impetus to the global harmonization of standards; IOSCO provides the foundational blueprint.

The Timeline to Implementation

The journey to a regulated ESG ratings landscape is a phased one, with all market participants having time to adapt:

Beyond Ratings: Why Your Internal Data Management is the Foundation

While regulating the output (the ratings), this legislation underscores the non-negotiable importance of the input: your corporate ESG data. A regulated rating based on poor-quality data is a significant liability.

This is where technology becomes your most strategic ally. The complexity of modern ESG data, especially the labyrinth of Scope 3 emissions management, makes manual processes and spreadsheets obsolete.

An integrated ESG data management platform has changed from a luxury to core infrastructure for both compliance and competitive advantage.

Here’s why a technology-led approach is critical:

| Challenge | Manual Process | With a Dedicated Platform |

| Data Collection | Manual, time-consuming, and error-prone, spreadsheets have to be e-mailed to suppliers | Automate workflows and aggregate data seamlessly with APIs.

|

| Methodology Adherence | Difficult to ensure consistent application of GHG Protocol across the organization. | Built-in calculation engines that automatically apply correct emissions factors and rules.

|

| Scope 3 Management | Not possible to collect and manage data from a complex supply chain. | Centralized portal for supplier engagement, primary data collection, and progress tracking.

|

| Audit & Assurance | Painful, quarter-long process to trace numbers and prove accuracy. | Immutable audit trail, full data lineage, integrated disclosure reporting.

|

| Stakeholder Trust | Reports are static and difficult to verify. | Provides one version of the truth – builds confidence for ratings agencies and investors.

|

Conclusion: Building Trust from the Inside Out

The UK’s decision to regulate ESG ratings is a significant step toward maturing the sustainable finance ecosystem. It certifies the importance of the role these ratings have played and sets about engendering the trust needed for them to spur meaningful change. The message to forward-thinking companies is clear: the time to invest in your data foundation is now. Reliable ESG ratings start with reliable internal data management. By implementing an efficient carbon accounting software, you will not only be ready for a regulated ratings landscape but also build a transparent, resilient, and valuable business for the future.

Snowkap provides the technological infrastructure that turns the complexity of ESG data into strategic clarity. Our platform helps you master your carbon accounting, streamline Scope 3 emissions management, and build the trusted data foundation that tomorrow’s market demands.

Ready to transform your ESG data from a compliance challenge into a strategic asset?

Book a free consultation with our experts to see how Snowkap’s platform prepares you for the era of regulated ESG ratings, turning transparency into your competitive advantage.

Sources: UK Government Legislation, Financial Conduct Authority (FCA), International Organization of Securities Commissions (IOSCO), European Securities and Markets Authority (ESMA).