Within the boardrooms of contemporary Indian corporations, a new statistic is competing for prominence besides EBITDA and ROI. Carbon accounts have entered the fray. Greenhouse Gas (GHG) emissions, which have their roots in Environmental Science, have come to play a determining role in strategic risk management, capital access, and long-term competitiveness. For astute business leaders, GHG emissions are no longer a function of regulatory requirements. The imperative is fiduciary responsibility in a rapidly decarbonizing global economy.

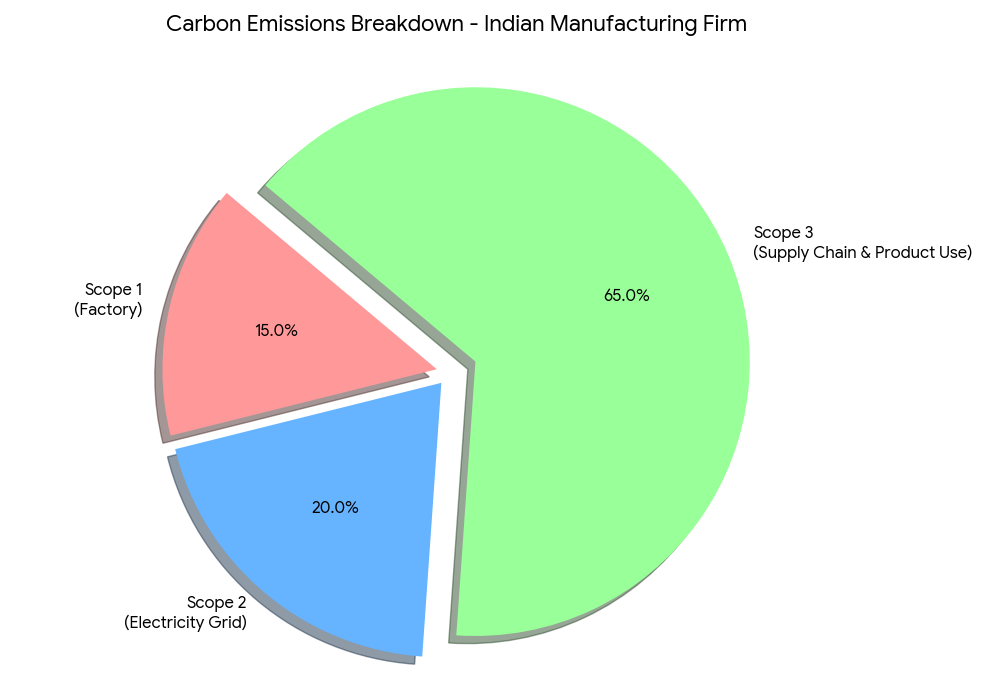

Breakdown of Carbon Portfolio: Scope 1, 2, and 3 Emissions

GHGs include gases in the atmosphere that trap heat, of which carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and fluorinated gases are identified as significant sources of emissions from human activities. For business-level accounting, it has been classified into three scopes of operation.

- Scope 1: Direct Emissions. Emissions that occur from sources that are controlled by the company. In the Indian context, direct emissions are generated by boilers in factories and captive power plants, as well as by company vehicles and processes such as cement or metals production.

- Scope 2: Indirect energy emissions. Emissions that can be attributed as a consequence of the production of purchased electricity, steam, heating, and cooling used in the business. Looking at the current Indian energy mix of large coal usage and increased focus on renewables, Scope 2 emissions can be considered an essential and rapidly developing area through the use of Energy Attribute Certificates and Power Purchase Agreements.

- Scope 3: Value Chain Emissions: This is the broadest and usually the most complex one as it subsumes all other types of indirect emissions. It would comprise both the upstream ones (purchase goods/services, business travel, waste) as well as the downstream activities (use of produced goods, disposal of sold products). For a typical manufacturing firm operating in the Indian context, Scope 3 emissions can potentially embrace 65-85% of the total carbon footprint.

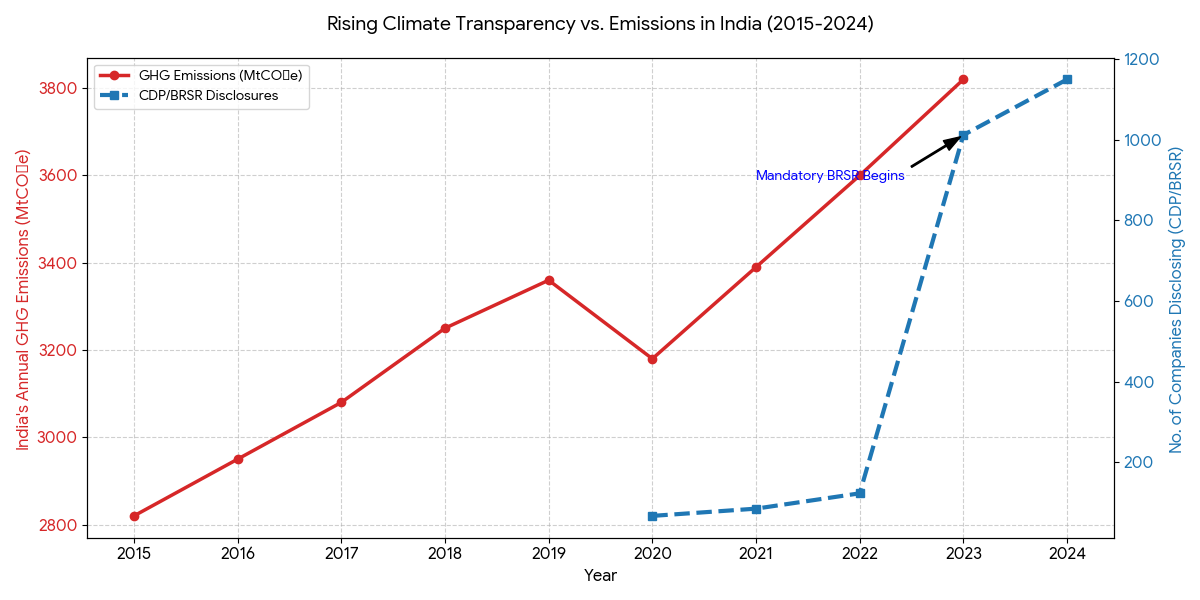

The Indian Landscape: Data, Drivers, and Disclosure

India has the third-highest GHG emissions by sheer volume, but its per-capita level is much lower than the global average. This has been fueled by a whole plethora of factors, including rapidly growing urbanization, industrialization, and an energy-intensive development path. As of the latest available estimates (2023), the energy sector leads the GHG emissions mix in India, which accounts for 75%, followed by the agriculture sector (14%), and industrial procedures (8%).

For the Indian economy, the environment is getting more challenging. With regard to this issue, the Securities and Exchange Board of India (SEBI) has ordered “Business Responsibility and Sustainability Reporting (BRSR) for the top 1000 listed companies” and has asked for GHG emissions data. This also matches international policies, like the “Task Force on Climate-related Financial Disclosures (TCFD)” and the “International Sustainability Standards Board (ISSB).” Moreover, the “Carbon Border Adjustment Mechanism (CBAM) adopted by the EU” is an obstacle for export-oriented industries (Steel, Aluminum, Fertilizers) and an impetus for fast-tracking decarbonization.

From Cost Centre to Strategic Advantage

Treating the release of GHG gases simply as an environmental expense is a deeply flawed strategic insight. Savvy CFOs now see these emissions as a ‘proxy’ for operating efficiency and risk.

- Risk Management: The physical risks (extreme weather patterns upsetting supply chains) and transition risks (carbon taxes, consumer behavior) affect the balance sheet. Practicing proactive carbon management involves financial hedging.

- Capital Access & Cost: Globally active institutional investors and lenders are now increasingly incorporating climate-related risks in their assessments. Establishing effective net-zero transition plans and ESG fundamentals can reduce capital costs and provide access to sustainability-linked loans and green bonds.

- Operational Efficiency: The challenge of reducing emissions is inextricably intertwined with energy efficiency, waste management, and process improvements, which are key margin drivers.

- Market Leadership: With the increasing levels of sophistication exhibited by Indian consumers as well as the business-to-business market, the value offered by an effective sustainability plan is crucial for market leadership in the green economy.

The Role of Technology and Expertise

Accurate GHG inventory management, especially for Scope 3, is a complex data challenge. It requires consistent emissions factors, activity data aggregation, and rigorous GHG protocol adherence. This is where purpose-built technology becomes indispensable.

At Snowkap, we recognize that carbon accounting is the essential base layer upon which all good climate planning must be built. Our solution aims to simplify this complexity for Indian companies. We facilitate effortless data extraction, automated calculations according to the most up-to-date IPCC methodologies and National GHG Inventories, and provide audit-compliant reporting for BRSR, CDP, and other standards. But beyond all this, Snowkap also offers the analytical insights necessary to pinpoint material reduction priority areas, simulate reduction pathways, and monitor and measure continued progress toward Science-Based Targets, or SBTs.

The Future Course: Integration and Innovation

The mandate is clear. For India’s corporate leadership, the task is to integrate GHG emissions management into the core financial and operational DNA of the enterprise. This involves:

- Robust Measurement: Establishing a comprehensive, auditable baseline.

- Ambitious Target Setting: Committing to science-based targets for net-zero.

- Strategic Abatement: Investing in energy efficiency, renewable energy, and carbon removal technologies where necessary.

- Transparent Disclosure: Proactively communicating progress and strategy to stakeholders.

The transition to a low-carbon economy is the greatest commercial opportunity of our century. It demands a shift from seeing emissions as a liability to recognising their management as a core competency for growth, resilience, and leadership.

Ready to transform your carbon ledger from a reporting challenge into a strategic asset?

Partner with Snowkap to measure, manage, and master your decarbonisation journey.